Mobile Check Deposit

What is Mobile Check Deposit?

Truliant's top-rated Truliant App lets you deposit checks quickly and securely, 24/7, right from your smart phone. Whether you have a personal or business account, you can deposit checks from anywhere without a trip to your local branch or ATM. Download from the App Store or Google Play.

It's convenient and easy. Simply use the Truliant app on your phone to take a picture of the check and follow the steps shown to deposit it into your preferred account.1

Key features (with latest version of the Truliant app):

- Deposit multiple checks at one time

- Amount of check entered based on image, no manual entry required

- Warning error before you deposit check if something is incorrect

- Available in Spanish (Disponible en Español)

To use Mobile Check Deposit, members must:

- Have a qualifying checking or savings account or loan with Truliant

- Maintain personal and/or business accounts in good standing

- Be enrolled in Truliant’s digital banking – To sign up, download the Truliant app or visit Truliant.org and select ‘Sign Up’

How do I use Mobile Check Deposit?

To avoid processing delays or returned checks when using the Truliant app, please follow the steps below:

- Be sure you have the latest version of the Truliant app downloaded so you have access to all features.

- Sign your name on the back of your check and be sure to clearly print "For Mobile Deposit at Truliant" on the line(s) below your signature.

- Log into the Truliant app and select 'More' at the bottom of your screen.

- Click 'Mobile Check Deposit' at the top.

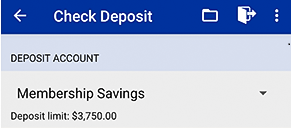

- Choose the account you'd like to deposit the check into.

- Take a picture of the front of the check, if the image is clearly visible, tap 'Continue'. You can also select 'Retake' if needed.

- Take a picture of the back of the check and if the image is clearly visible it will return you to the screen. You can also select 'Retake' if needed.

- Repeat steps 5-7 to deposit additional checks.

- Click 'Submit' to finish. All checks will be submitted at the same time.

You can also deposit a check from your computer and scanner by using Online Banking. Simply log into Online Banking and select ‘Mobile Check Deposit’ from the ‘Additional Services’ drop down menu. Then, upload your check scans or images as instructed.

What are the requirements to use Mobile Check Deposit?

To use Mobile Check Deposit, you must:

- Follow the guidelines in terms of endorsement. Guidelines can be found under Agreements and Disclosures within online and mobile banking.

- Maintain personal and business accounts in good standing

- Sign up for Digital Banking

- Must be at least 16 years of age

Mobile Check Deposit FAQs

Sometimes, we need to manually process a check that has been submitted through Mobile Check Deposit. If one of your checks is selected to be manually processed, we will typically process these within one business day. Please do not resubmit your check for processing.

Once we review your check, you will receive an email notification. To be sure that you receive these notifications, make sure that your email address is up to date with us. You can review your email address and other information by selecting the gear icon in the top right under the 'More' menu in the Truliant app or by going to 'My Settings' in Online Banking.

If you find your banking needs frequently exceed these limits, we may be able to help. Give us a call at 800-822-0382 and ask your representative about increasing your mobile deposit tier (subject to approval).