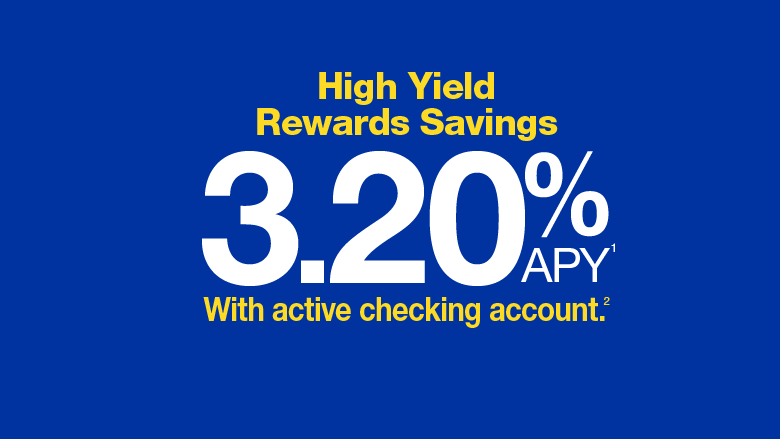

Earn 3.20% APY with a High Yield Savings Account

It’s easy to qualify—and you’re probably already doing it!

Open a High Yield Savings Account3 and start earning an impressive 3.200% APY on balances up to $25,000—just by having an active Truliant checking account.

Here’s what makes your checking account “active”:

Open yours today—it only takes a few minutes!

Open a High Yield Savings Account3 and start earning an impressive 3.200% APY on balances up to $25,000—just by having an active Truliant checking account.

Here’s what makes your checking account “active”:

- $500+ in monthly deposits from sources outside Truliant

- Primary account ownership of both the checking and savings accounts

- 10+ withdrawals per month, including debit card purchases, bill payments, automatic transfers—even loan payments count!

Open yours today—it only takes a few minutes!

High Yield Savings Account Calculator

(1) APY = Annual Percentage Yield. Rates are accurate as of January 1, 2026. Rates are subject to change monthly as determined by the Board of Directors of the Credit Union. To see our Account Terms and Deposit Account Agreement for more information about your accounts, dividends, fees and features, log in to online or mobile banking.

(2) The terms of the account, including any fees or features, may change. Fees may reduce earnings on this account. The primary owner of the High Yield Rewards Savings account must be the owner of the checking account (joint owners of checking accounts are not included). Premium Rate 3.200% APY: To receive the premium interest rate an active checking account that meets monthly minimums of $500 in deposits and 10 withdrawals is required. The premium rate will be applied at the end of each month on balances up to $25,000. Non-Premium Rate 1.00% APY: Interest rate will decrease for balances above $25,000. Base Rate 0.10% APY: Interest rate applied if checking activity doesn't qualify. External deposits include: ACH (Direct Deposit), mobile & ATM deposits, checks deposited from a non-Truliant account, in-coming wire transfers. Withdrawals include: Debit card purchases (Point of Sale), checks, ATM, ACH, out-going wire transfers, withdrawal from a Truliant account to make a payment on a Truliant loan. Excluded transactions: internal transfers between Truliant deposit accounts and loan proceeds being deposited into your account from a Truliant loan.

(3) Avoid a service fee by maintaining $1,000 average monthly account balance. Minimum $1,000 to open this account. One High Yield Savings account per membership.

The Base Rate (lowest) Annual Percentage Yield (APY) will be displayed in the Account Details section of online and mobile banking for all accounts (0.10% APY may be listed)—even if you're actually earning a higher premium rate. Refer to your monthly account statement for your actual earnings and specific rate details.

(2) The terms of the account, including any fees or features, may change. Fees may reduce earnings on this account. The primary owner of the High Yield Rewards Savings account must be the owner of the checking account (joint owners of checking accounts are not included). Premium Rate 3.200% APY: To receive the premium interest rate an active checking account that meets monthly minimums of $500 in deposits and 10 withdrawals is required. The premium rate will be applied at the end of each month on balances up to $25,000. Non-Premium Rate 1.00% APY: Interest rate will decrease for balances above $25,000. Base Rate 0.10% APY: Interest rate applied if checking activity doesn't qualify. External deposits include: ACH (Direct Deposit), mobile & ATM deposits, checks deposited from a non-Truliant account, in-coming wire transfers. Withdrawals include: Debit card purchases (Point of Sale), checks, ATM, ACH, out-going wire transfers, withdrawal from a Truliant account to make a payment on a Truliant loan. Excluded transactions: internal transfers between Truliant deposit accounts and loan proceeds being deposited into your account from a Truliant loan.

(3) Avoid a service fee by maintaining $1,000 average monthly account balance. Minimum $1,000 to open this account. One High Yield Savings account per membership.

The Base Rate (lowest) Annual Percentage Yield (APY) will be displayed in the Account Details section of online and mobile banking for all accounts (0.10% APY may be listed)—even if you're actually earning a higher premium rate. Refer to your monthly account statement for your actual earnings and specific rate details.