Why Corporate Social Responsibility Is a Priority for Truliant

Truliant has always had a greater sense of purpose that goes beyond the financial transaction. We put our mission of improving lives into action with a strong sense of community, volunteerism, inclusion and philanthropy. Corporate Social Responsibility (CSR) is not something we do, it defines a part of who we are. Our focus on positive economic, social and environmental impact makes a difference in the lives of our members, as well as those around us.

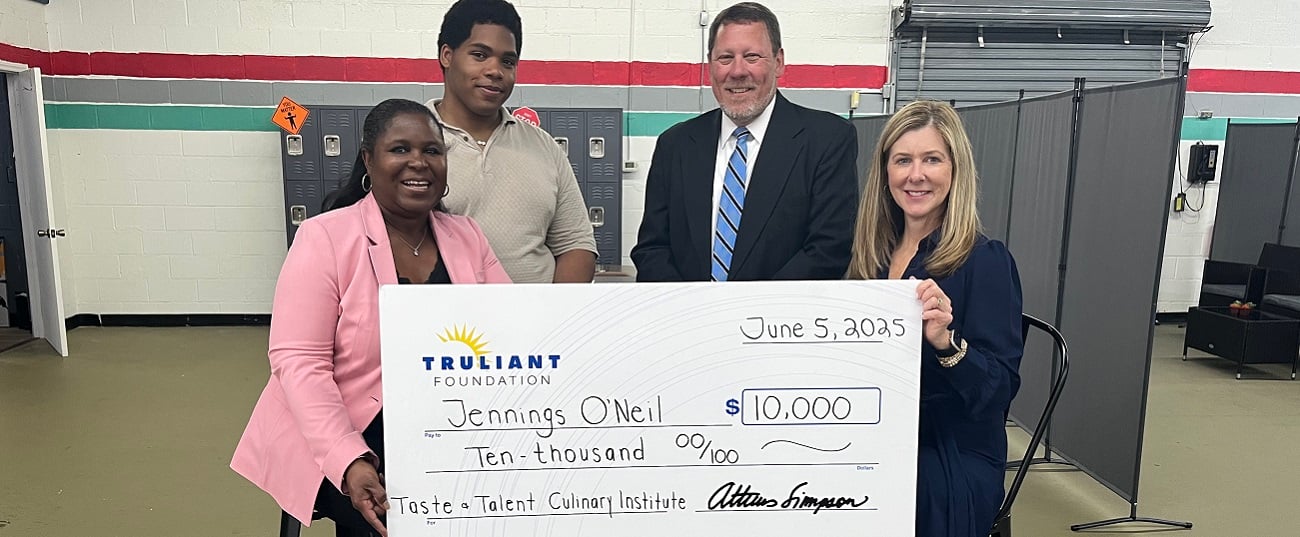

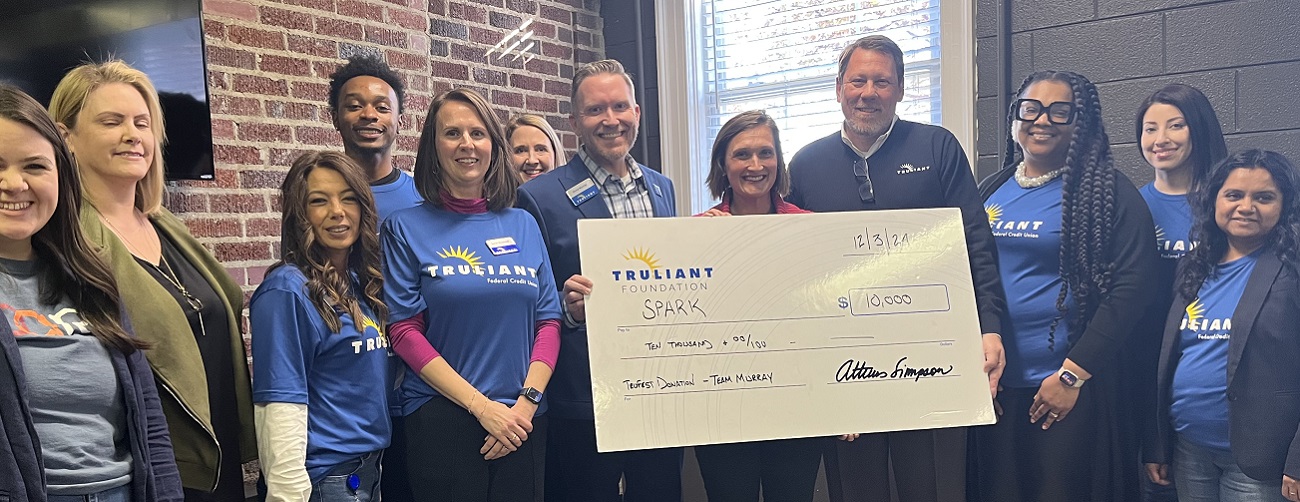

As an organization, we are committed to fostering an inclusive workplace, serving the underserved, and promoting sustainability and financial wellness. We sponsor a variety of community events and organizations, and provide grants and scholarships through the Truliant Foundation. We are an active part of every community we serve and want to see them thrive so we can all lead better and more healthy lives — together. In other words, we make business personal.

Brighter Together - Truliant's Impact Report

As an organization, we are committed to fostering an inclusive workplace, serving the underserved, and promoting sustainability and financial wellness. We sponsor a variety of community events and organizations, and provide grants and scholarships through the Truliant Foundation. We are an active part of every community we serve and want to see them thrive so we can all lead better and more healthy lives — together. In other words, we make business personal.

Brighter Together - Truliant's Impact Report

How We Make a Difference

Our social responsibility efforts are structured around five pillars. Each is focused on a different core belief important to our members and employees.

Our Annual Impact

--

community organizations supported by the Truliant Foundation

--

financial education workshops for business and community partners

--

charitable giving supporting low income communities

--

pounds of carbon dioxide offset by 742 solar panels

TruCommunity, True Impact

As a financial institution and lender, we know the importance of delivering on our promises and generating real results. We ultimately measure our success in how we're able to benefit our communities and improve the lives of the people in them.

Learn about our latest CSR efforts in our twice yearly (bi-annual) Impact Reports.

Learn about our latest CSR efforts in our twice yearly (bi-annual) Impact Reports.